Here’s where things get clearer. Once you understand where your HMRC tax code sits on your payslip, why it looks the way it does, and what to do when it goes wrong, the whole tax-code drama starts feeling more manageable. Think of this as the friendly walkthrough you wish someone had given you the first time you spotted 1257L, BR, or something even stranger blinking beside “PAYE.”

Let’s talk through it in the simplest, most human way possible.

Why That Little Tax Code Matters More Than You Think

A tax code isn’t random. It’s HMRC’s way of telling your employer how much tax to take off your income under PAYE. If the code is right, your monthly deductions fall into place. If the code is wrong, the numbers shift fast sometimes too fast.

Many people only discover an issue when their payslip suddenly feels “lighter” or when universal credit payments change unexpectedly. So the first step is knowing what the code is actually trying to tell you.

Most UK workers see the classic 1257L currently the most common code and usually a sign that you’re getting the standard tax-free allowance. But other codes carry their own stories. A BR code often appears if HMRC thinks you have a second job or untaxed income somewhere else. OT or 0T pops up when HMRC doesn’t have enough information about your income yet. And K-codes flip the tax-free logic on its head when you owe tax from benefits or previous adjustments.

Bottom line: the code on your payslip isn’t just a label. It’s the gateway to understanding whether you’re paying too much, too little, or exactly the right amount.

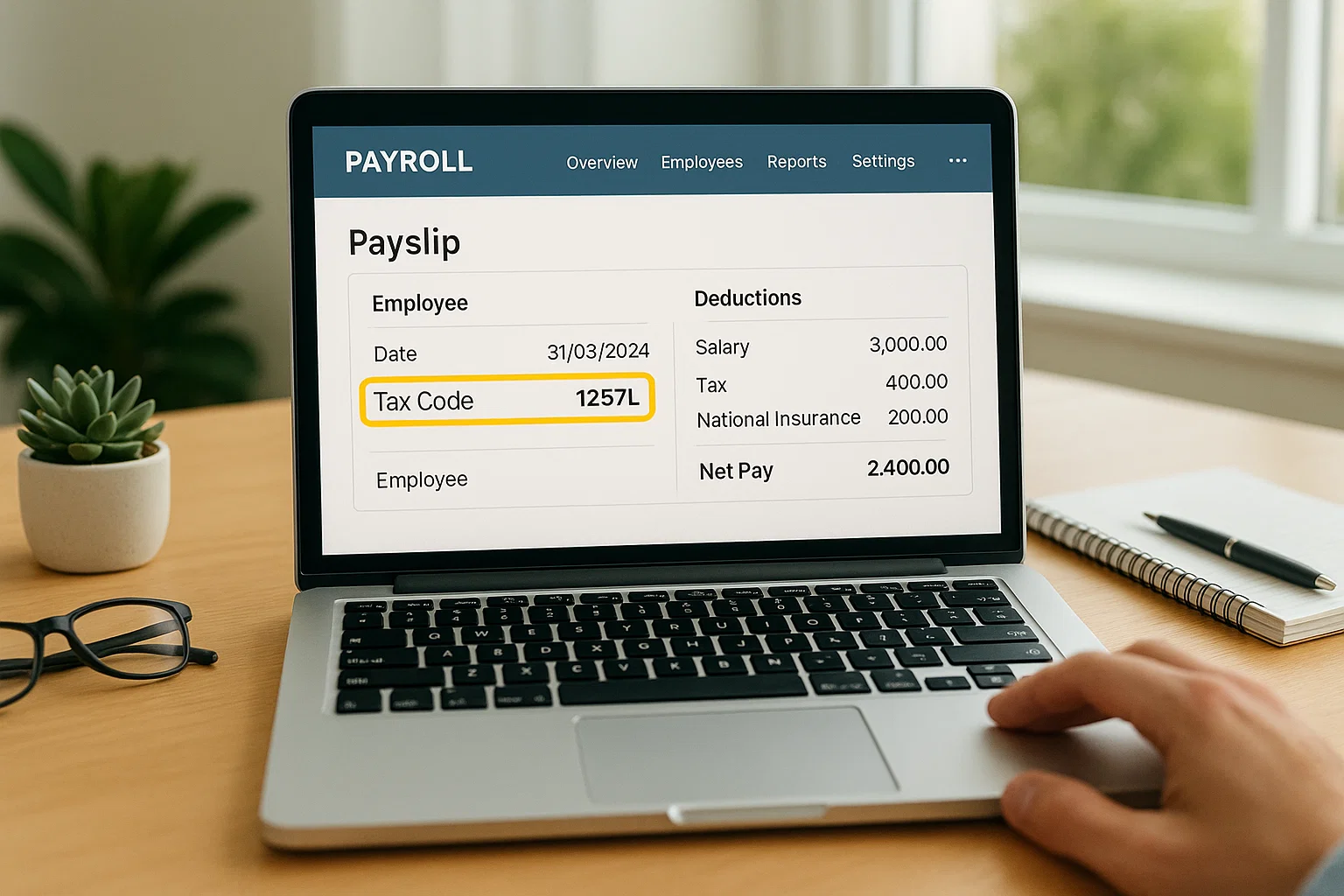

Where The Tax Code Actually Sits On Your Payslip

Most payslips hide it in plain sight.

It usually shows up near:

- The PAYE or Tax section

- The deductions column

- The employee earnings header

Digital portals things like SD Worx, iTrent, Sage, MyView and other HR dashboards place the tax code neatly under “Tax details” or “PAYE information.” If your workplace recently shifted to online payslips, the layout might feel a bit tidier, but the code still sits in that same area.

The trick is to look for the short alphanumeric code, usually ending in a letter: L, M, N, T, or sometimes nothing at all. Once you spot it, checking your tax code becomes a lot easier because you now know exactly what HMRC believes about your income and allowances.

What That Code Means In Everyday Language

Let’s break down a few of the common ones without turning it into an accounting lecture.

1257L

The “standard” UK tax code for most workers. It means you get the normal personal allowance spread across the year. No drama here unless HMRC updates your situation and forgets to tell you (it happens).

BR

Short for “Basic Rate.” Usually means HMRC believes this income is from a second job or an extra stream that shouldn’t get an allowance. You’re taxed at 20 percent from the first pound. Sometimes correct, sometimes not.

0T / OT

This one confuses everyone. It means HMRC doesn’t have enough information to give you an allowance yet. Often happens when you change jobs and your new employer doesn’t receive the P45 on time.

D0 / D1

Higher-rate and additional-rate tax applied from the first pound. Mostly seen on second incomes.

K-codes

These look like a mistake when you first see them, but they’re real. They’re used when you owe tax for benefits, adjustments, or previous underpayments. Your employer ends up deducting extra tax each month until the balance evens out.

The list of tax codes is long, but most people only come across five or six of them in a lifetime. The key is knowing that these codes all reflect how HMRC interprets your financial picture.

How To Know If Your Tax Code Is Actually Correct

Here’s where the worry usually creeps in:

“What if my tax code is wrong and I’ve been paying the wrong amount all year?”

You’re not alone. A lot of people check their payslip for the first time in months and suddenly realise something looks off.

Start here. It’s simple and reliable:

Step 1 Check Your Last PAYE Coding Notice

HMRC sends these when anything changes new job, new benefit, new adjustment. If your coding notice doesn’t match your payslip, that mismatch is your first clue something isn’t right.

Step 2 Log Into Your HMRC Personal Tax Account

This is the clearest view of what HMRC believes your tax code should be. Under “PAYE Income,” you’ll see your current code and any future changes they plan to apply.

Step 3 Compare It With Your Payslip Code

If both codes match, you’re fine.

If not, something needs fixing.

Step 4 Think Through Recent Life Changes

A new job, new benefits (company car, medical insurance), switching hours, or claiming expenses can shift your tax code mid-year.

Once you’ve done these checks, you’ll have a sharp idea whether the code on your payslip is behaving or causing trouble.

Why 1257L Sometimes Means You Owe Tax And Sometimes Doesn’t

This is one of the most searched questions in the UK.

People see 1257L and immediately think of two things:

- Relief “Great, this looks normal.”

- Panic “Wait, does this mean I owe something?”

The truth is simple.

1257L doesn’t automatically mean you owe tax.

It only means HMRC has given you the standard allowance. Whether you owe extra depends on your total income, benefits, and previous adjustments.

Where people get caught out is when HMRC adjusts the code to fix underpayments from earlier years. You might still see 1257L, but the tax taken each month could be slightly higher because HMRC spreads repayments across the year.

So the code itself looks harmless but the numbers tell the real story.

The Most Common Codes You’ll See In The UK

Here’s a quick reference table you can drop straight into your article layout. (This is one of your allowed two tables.)

| Tax Code | What It Usually Means |

|---|---|

| 1257L | Standard tax-free allowance for most workers |

| BR | Income taxed at basic rate only, no allowance |

| 0T / OT | No allowance applied; not enough information |

| D0 | 40% tax applied from the first pound |

| D1 | 45% tax applied from the first pound |

| K-codes | You owe tax; allowance reduced below zero |

A small reminder: none of these codes are “bad.” They just tell a story about your current tax situation.

How To Fix A Wrong Tax Code Without Stress

If your payslip code doesn’t match HMRC’s version or just feels wrong fixing it is easier than people expect.

Start with the Personal Tax Account, because that’s where HMRC updates everything first. If you believe your code is wrong, there’s a “Check your tax code” option where you can report incorrect details. HMRC usually adjusts it quickly and sends a new coding notice straight to your employer.

If the issue looks urgent, you can call the HMRC tax code helpline. Be prepared with your NI number, employer details, and the code shown on your payslip. Most fixes happen on HMRC’s side, not through payroll teams.

Your employer can’t change your code manually they can only apply what HMRC sends them. Once HMRC updates their system, your next payslip should show the corrected code automatically.

Why Your Tax Code Changes Mid-Year (Even When Nothing Seems Different)

Sometimes you’re doing everything the same same hours, same job, same income and the tax code suddenly shifts. It’s not always a mistake.

Here are the usual reasons:

You changed jobs

Your old and new employer sent information at different times.

Benefits were added

Company car, private health cover, fuel card, and similar perks affect your tax.

Expenses or allowances were updated

Claiming mileage relief or uniforms can shift things too.

Universal Credit adjustments

Your UC payments may trigger small coding updates.

HMRC fixed past underpayments

They often spread repayments across the year through your tax code.

None of this means you’ve done anything wrong. It’s just the HMRC system catching up with your real-life details.

Troubleshooting A Tax Code That Doesn’t Look Right

Here’s a quick checklist your second and final allowed “list-style” section.

- Does your payslip code match the one inside your HMRC Personal Tax Account?

- Has HMRC recently sent you an email, letter, or coding notice?

- Did you switch employers, roles, or working hours?

- Are you receiving benefits that weren’t applied before?

- Do the tax deductions feel suddenly too high or too low?

When something doesn’t look or feel right, trust your instincts. Payslip changes rarely happen without a reason, and a small mismatch can reveal a bigger issue.

FAQ Section Clear, Calm, And Human

How do I find my PAYE tax coding notice?

HMRC sends it to your online Personal Tax Account, and sometimes through the post. It sits under your PAYE income details.

What is the most common tax code on a payslip?

1257L it’s the standard one for most UK employees.

How do I check if my code is correct?

Compare the code on your payslip with the one inside your HMRC Personal Tax Account. They should match.

Does 1257L mean I owe taxes?

Not automatically. It only means you’ve been given the standard allowance. Any extra deductions usually relate to previous adjustments.

How do I get my HMRC tax check code?

You generate it inside your Personal Tax Account. It confirms your identity and employment details when needed.

And Here’s The Part People Often Forget

Your payslip isn’t just a record it’s your monthly check-in with HMRC’s version of your financial life. If the code on it makes sense, you’re good. If something looks strange, you don’t need to panic. You just need to follow the breadcrumbs.

A quick glance at your HMRC Personal Tax Account, a comparison with your coding notice, and a little awareness of recent changes in your work life are often enough to clear everything up.

Understanding your tax code doesn’t magically make PAYE fun but it does make it far less frustrating. And once you get used to spotting the signs, your payslip becomes something you can read with confidence rather than confusion.

Rishi Sharma, experienced blogger & WordPress developer, excels in digital marketing & SEO. Delivers high-quality content at https://blog.spinbot.uk/, enhancing online visibility & earning potential.